List your space

Contact Us

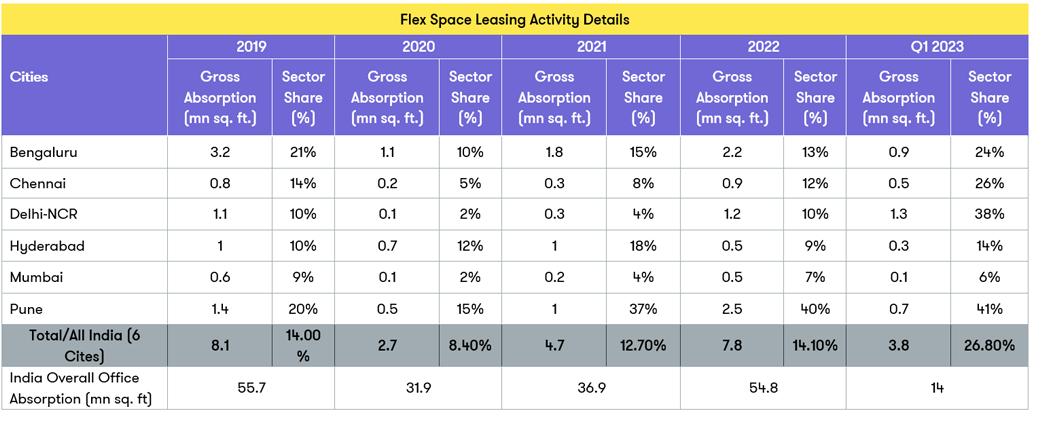

A quick look at the headlines and statistics will tell you part of the story. India saw 7.8 million sq ft of take-up in 2022 across the six main commercial hubs of Bengaluru, Chennai, Delhi-NCR, Hyderabrad, Mumbai and Pune with this total take-up accounting for 14% of all office take-up in these areas. This figure was just shy of the 8.1 million sq ft in 2019’s pre-pandemic levels, although it is important to note that this bounce back to pre-Covid levels has been considerably faster than almost all other countries. This year, flexible office take up in India has continued on its upward trend with Q1 2023 take-up already at 3.8 million sq ft, which represents 27% of all office take up and indicates that 2023 could be a record year for flex in India.

A large portion of growth, especially in markets such as Bengaluru, is down to the expansion of Global Capability Centres (which house a business’s-critical operations), with Microsoft and Google both occupying over a 1 million sq ft in managed flex space of this nature. This is often the preferred route of a global corporate when securing space in India, and as such we have seen leading managed space providers such as Table Space and Simpliworks amass substantial portfolios.

So why is flex and coworking such a roaring success in India and what lessons can other markets learn from this?

India is still struggling to get staff back to the office with many people preferring to work more often from home. I understand from those I spoke to on my visit, that a key reason for this is traffic. Whilst all the major cities are building / expanding their public transport networks, except for Delhi NCR, they are not yet fully operational and traffic remains at the heart of everyday life. In many areas a person’s daily commute to the office can be up to or sometimes even more than two hours, resulting in a four hour round trip per day. For people doing this commute on a daily basis the office has to provide something they won’t get at home.

I quickly learnt on many visits to office locations across India that it is the flex spaces that appear to be the busiest, while more traditional office spaces are still some distance away from the pre-pandemic occupancy levels. The amenities that flex space offer such as on-site cafeterias, break-out areas, free tea and coffee, and events and community engagement, seemed to be one of the biggest draws for staff. One aspect of particular note was how busy the ping pong tables were in the flexible offices spaces. I have visited many flex offices across the globe and I have never seen them used so frequently by staff using it as an area to socialise and collaborate or simply refresh and focus their mind. In many markets the ping pong table is often seen as the gimmick or the sales tool for co-working, and whilst they might get some use, often at the end of the day, it was nothing like what I saw in India. The shared amenity was at the heart of every space, whether co-working, serviced office or even a managed space, there was always a thriving hub of people, work and collaboration, with everyone enjoying everything that was on offer. It seems that staff were voting with their choice of company and workplace. Flex was winning by way of the amenity it was providing as well as the wider benefits of flexibility and limited or no capex spend.

In the UK we have seen landlords entering the flex office market by offering their own product to compete with operators. However, in India, landlords have taken a slightly different approach by generally aligning with a preferred operator, either via purchasing that operator in part of whole, or undertaking a strategic partnership with them. In some ways it is therefore almost closer to the wholesaler and retailer model. The landlords provide the bricks and mortar with the operators providing the service and experience that the customers want. Both recognise their roles and are happy to play to their respective strengths.

It will be interesting to see whether this dynamic remains or whether more landlords seek to take a direct slice of the pie with their own operation as seen in other global markets. Nonetheless, the scale of demand for flex, from businesses big and small, means for the medium term at least, there is plenty of opportunity for all. In particular, it is important to note the ongoing important of the flex office market in supporting the growth of start-ups and small businesses in India and plays a vital role in the continued evolution of the overall office ecosystem.

Looking for a new office or want to list your office space for rent? Our team of experts are on hand to help.